Rumors are ripe about an official co-branded Marriott Credit card in India. Given the increased focus of Marriott on India and their existing relationships, it makes a lot of sense.

Update: HDFC Marriott Bonvoy Credit Card launched in India.

However, there is already a credit card in India that beats the benefits of Marriott co-branded cards in several countries – Amex Platinum.

Let’s have a quick look at Marriott related benefits of American Express Platinum Card in India.

- Marriott Gold Elite Status for as long as you hold the card.

- 1 lakh bonus Marriott Bonvoy points (or Rs.45,000 Taj Vouchers) on signup (Additional 10,000+ bonus points if you this referral link)

- 12.5 Marriott Bonvoy points per Rs.100 spent on Marriott stay bookings via the card.

- 12.5 Marriott Bonvoy points on shopping online at Amazon, Flipkart, Tata Cliq and several other major sites.

- 2.5 Marriott Bonvoy point for every Rs. 100 spent on the card. Except a few categories.

- 7.5 Marriott Bonvoy points for every Rs. 100 spent in foreign currency. (International transactions as well as online transactions in other currencies)

- Promotional offers – e.g. 20% off on Marriott hotels for cardholders.

Now let’s dive a little deeper into how all this works, shall we?

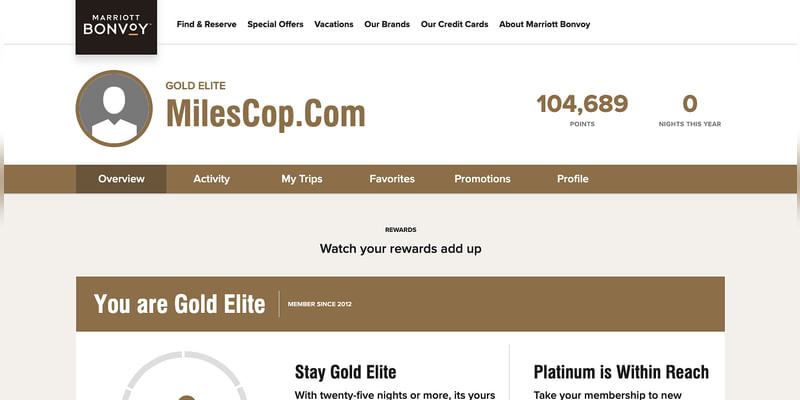

Marriott Gold Elite Status

As soon as you have the card in your hand, you can apply for Marriott Gold Elite status via Amex. The entire process is online. It takes around a week for your account to reflect the new status.

The status remains active for as long as you hold the card.

You also get Hilton and Radisson Gold with the card. That’s something you can never expect from an official card.

At MilesCop, we regularly write about how you can make the most of your elite status with various loyalty programs.

Well, there’s more.

Marriott, Hilton, and Radisson Gold Elite status are available for supplementary cardholders as well. Yes, for all 4 of them. For free. For as long as you hold the card.

My entire family is Gold with Marriott, Hilton, and Radisson, thanks to this one card.

Earning Marriott Bonvoy points

Even though it may seem like so, the card is not officially a Marriott co-branded card. That means you earn Amex Membership Reward Points and not Marriott Bonvoy points.

However, you can transfer your Amex MR points to Marriott for a straight 1:1 ratio. Plus, there is no points transfer fee for Platinum cardholders. So, it’s as good as earning Bonvoy points.

There are other hotels and airline partners, in case you want to transfer your Amex MR points to any of them.

Occasionally, Amex offers bonus points on transfer as well. This can get you 30% or more bonus points, at times.

Earning Accelerated Marriott Bonvoy Points.

You get 1 point for every Rs.40 spent on the card. That’s 2.5 Marriott Bonvoy points for every Rs. 100 spent on the card.

There are a few exceptions, like insurance and utility payments.

However, you can earn as much as 12.5 points per Rs.100 spent with certain merchants.

12.5 Marriott Bonvoy points for every Rs.100 spent.

Amex Platinum gives you 5x reward points, i.e., 12.5 points per Rs. 100, on using your card at certain merchants online.

Good thing is, the list of merchants probably covers most of your online shopping. Here are a few of them

- Marriott Hotels

Amazon, Tata Cliq, Myntra, Ajio, Flipkart (Including groceries and pantry).- Marks and Spencer’s, Apple, OnePlus, Lenovo

- Tanishq, Forest Essentials etc.

The list is pretty long. The point is that you can earn a lot more Bonvoy points with this card for your regular spends.

You can view the list of merchants here.

12.5 Marriott Bonvoy points on purchasing gift cards.

American Express has a tie-up with Gyftr in India. You can purchase gift cards and vouchers for hundreds of brands and earn 12.5 points per Rs.100 spent.

You can buy Uber gift cards and earn 12.5 Marriott points for every Rs.100 spent on Uber in India.

There are 100s of brands to choose from. You can view the complete list here.

7.5 points for every Rs.100 spend in foreign currency

Amex Platinum offers 3x reward points, i.e. 7.5 for every 100 spent, for all foreign currency spends.

A part of it balances out the currency conversion fee but you still earn good points. Add to that the reliability and security of Amex while traveling and it suddenly seems like the best card ever for international spends.

You earn 3x points for online transactions made in foreign currency as well.

Amex-Marriott Promotions

Occasionally, American Express cardholders get 20% off or other promotions for all Marriott bookings. Even though these are not permanent, we can expect such offers time and again.

Combine this with the 5x points offer we discussed earlier, and we have a very lucrative deal.

Lounge access and other travel related benefits.

You also get the following lounge benefits with the card:

- Amex Lounge access worldwide for primary and all supplementary cardholders.

- Unlimited Worldwide (except India) Priority Pass for basic cardholder and 1 supplementary cardholder. With access to digital Priority Pass (through Priority Pass app).

You get access to Amex Platinum Concierge Service. They can help you plan and book holidays, assist with Visa applications, arrange for gifts and flowers and even do online research for you (Find an Indian store in Finland?).

Sign-up bonus and Annual fees.

It’s time to address the elephant in the room – annual fees.

Yes, an annual fee of Rs.60,000 plus GST (18%) is a lot. However, the benefits far outweigh the fee.

Let’s look at the signup bonus. You get 1,00,000 points on signup. 1,10,000 (or more) if you use our referral link here.

Marriott Bonvoy point value can be stretched to Rs. 0.80 to Rs. 1 or even more if used smartly.

So, 1,10,000 Marriott Bonvoy points can be redeemed for a value of Rs.85,000 or more. Of course, it depends on your travel plan but you get a better value at international properties generally.

Add to it 2 unlimited priority pass memberships and Marriott, Hilton and Radisson Gold elite for up to 5 members, Taj Epicure Membership for 1.

That’s already worth more than 2 years of membership fee.

What about renewal?

The benefits we discussed here are the regular stated benefits. However, the offers you get throughout the year are not just great, they are crazy at times.

Take for example a few of the past offers - 25% off on Tata Luxury, Rs. 5000 - 18,000 cashback on online shopping, Rs. 5000 free purchases on Google Play Store and Apple Store etc.

Plus the regular offers like 50% off on Oberoi Suites, 30% off at Taj, 50% off at several great restaurants across the country, several free memberships etc.

You easily can earn back the annual fee.

However, it’s not a difficult choice. You get your money’s worth in the first year and then see if it’s worth renewing for the second year.

Conclusion

It’s hard for even an official Marriott Bonvoy Credit Card to beat these benefits. Only thing I can think of is - free nights on spends. Amex has really packed a punch with this one.