Earning Marriott Bonvoy points consistently through day-to-day expenses is likely the most efficient method to accumulate enough points for a complimentary holiday. Thankfully, there are now various Indian credit cards that enable users to earn or transfer reward points to Marriott Bonvoy. However, selecting the most suitable card can be a complex task.

For instance, all American Express cards permit the transfer of points to Marriott Bonvoy, HDFC offers an official co-branded card with Marriott, Axis Bank allows the transfer of edge rewards to Marriott, and so forth.

To make the most of your Marriott Bonvoy points with credit cards in India, here’s our recommended approach.

For regular expenses

We recommend applying for these two cards to maximize your Marriott Bonvoy earnings. It’s ideal to have both. If that’s not possible, choose the one that aligns with your spends better.

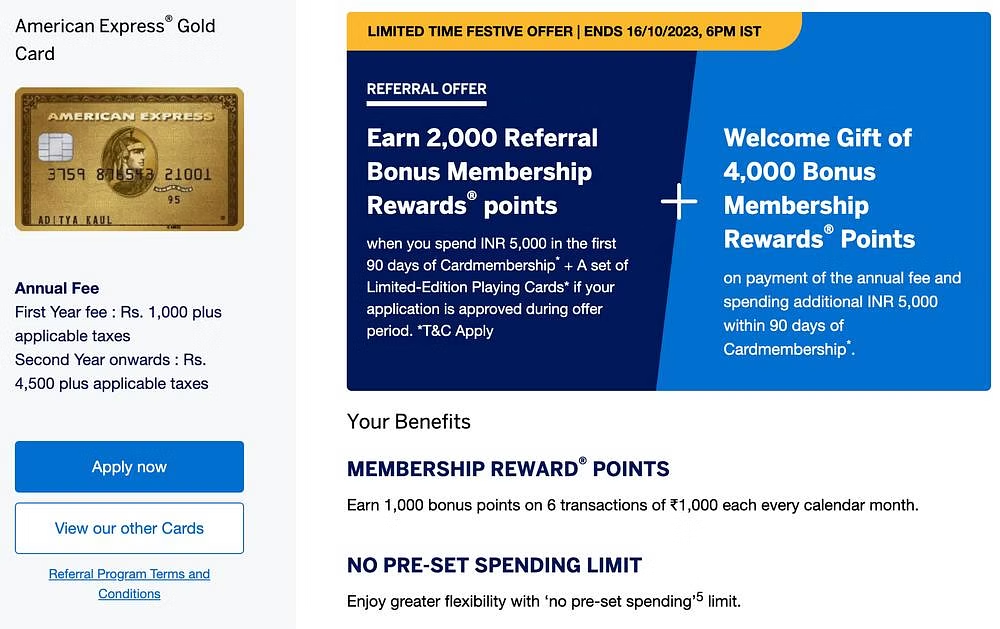

Card #1 – Amex Gold Charge Card

The first card we recommend is the Amex Gold Charge Card. This card allows you to earn approximately 10% points on every voucher purchase via Gyftr. For example, if you spend Rs. 10,000 on vouchers in a month, you will earn 1000 reward points (equivalent to 1000 Marriott Bonvoy Points). The best part is that these points are immediately awarded along with your regular reward points, unlike Axis Bank where you have to wait for 3–4 months.

Vouchers play a key role in the monthly expenses for most households. From paying bills on Amazon to shopping on Amazon, Flipkart, Myntra, Croma etc., to ordering food on Zomato or Swiggy to Uber for commutes to buying groceries on Big Basket or Blinkit - gift cards or vouchers are the way to go.

This is the easiest way to accumulate Marriott Bonvoy points for regular spends.

Get 1600 Marriott points every month for just 6 swipes.

Additionally, with the Amex Gold Charge Card, you will receive a bonus of 1000 points per month for completing 6 transactions of Rs.1000 or more in a calendar month. If you buy 6 vouchers worth Rs. 1000 each in separate transactions within a month, you will earn a total of 1600 points (1000 bonus points plus the 10% gift card points) in that month alone. This means you can accumulate close to 20,000 Marriott Bonvoy points in a year with minimal effort.

If you apply using this link, you will earn an extra 2000 bonus points, in addition to the regular 4000 welcome points. You also get a reduced first-year fee of Rs. 1000 plus taxes.

One more advantage of the Amex Gold Charge Card is that it is relatively easy to get approved for this card if you already have a credit card from any other bank showing on your CIBIL report.

Card #2 – HDFC Marriott Credit Card

HDFC recently launched India’s first Marriott Bonvoy Credit Card. It comes with numerous benefits and perks.

We recommend having it as the second credit card for Marriott Bonvoy Silver Elite status, 10 elite night credits, and one free night certificate.

This can also get you higher earnings than Amex Gold in certain categories of spends.

Here’s a comparison of points you can earn with HDFC Marriott Bonvoy Credit Card as compared to the Amex Gold Card.

| Type of Spend | HDFC Marriott | Amex Gold |

|---|---|---|

| Regular Spend | ~1.3 Marriott points per Rs. 100 (2 per 150) | 2 points per 100 |

| Travel | ~2.66 points per Rs. 100 | 2 points per 100 |

| Marriott hotels | ~5.33 points per 100 | 2 points per 100 |

| Dining and Entertainment | ~2.66 points per 100 | 2 points per 100 |

| Gift Vouchers | ~1.3 points per 100 | 10 points per 100 |

| Wallet Loads | 0 points | 2 points per 100 |

By carrying both the American Express Gold Charge Card and the HDFC Marriott Card in your wallet, you can easily accumulate a significant number of Marriott Bonvoy points in a year. Remember to use them smartly to maximize your earnings.

For International Spends

Currently, there are only 2 cards that offer accelerated reward points on foreign currency spends that can be converted to Marriott Bonvoy — Amex Platinum Charge Card, and Axis Bank Reserve Credit Card.

When converted to Marriott Bonvoy points, you earn approximately 7.5 Marriott Bonvoy points per Rs. 100 spent with Amex Platinum (3x), and 6 Marriott Bonvoy points per Rs.100 with Axis Reserve(2x).

Note that American Express charges a slightly higher forex fee than Axis Bank.

For Marriott Bonvoy points, Amex Platinum makes more sense as it offers more points, plus it comes with Marriott Bonvoy Gold status. However, both cards come with a hefty annual fee. 60,000 + GST for Amex, and 50,000 plus GST for Axis Reserve.

In case you have these 2 cards, they may give you better earnings for spends in most categories as compared to Amex Gold, and HDFC Marriott credit cards.

Of course, both cards come with several other benefits as well.

You can apply for Amex Platinum using this link to get an additional 10,000 points, along with other benefits like Taj Vouchers, Marriott Gold Elite, Hilton Gold Elite, etc.

Bottom-line

While there may be numerous factors and spend patterns that may influence the credit cards you keep in your wallet, these 2 cards are just about what most would need to boost their reward points balance.

Which credit cards do you carry in your wallet?